Community Messages & Alerts

North Dallas Branch Closure

After careful consideration, Resource One Credit Union has made the difficult decision to close our North Dallas location at 12770 Coit Road, Suite 100, Dallas, TX 75251, effective June 30, 2025. This decision is based on various factors, including market changes and evolving member needs, as we focus on optimizing resources to better serve you.

Safe Deposit Box: If you have a safe deposit box, please visit us or call 800-375-3674 to schedule an appointment for transfer arrangements by June 30, 2025. We’re here to help make the transition seamless.

Account Transition: Our team will work closely with you in the coming weeks to ensure a smooth transition, guiding you to access services at nearby branches or online.

Alternative Locations: Our North Garland branch (2475 Arapaho Rd, Garland, TX 75044) and Southside branch (1200 Belleview St, Dallas, TX 75215) will continue to serve you with the same great service. Thank you for your understanding.

Member Support: If you have any questions or need assistance, please contact our virtual branch at 800-375-3674 or email [email protected]. We’re here to help.

We sincerely thank you for your loyalty and support. Your trust has been vital to our growth, and we remain committed to serving you with excellence.

FAQs

Questions? We have answers. See below for our most frequently asked questions.

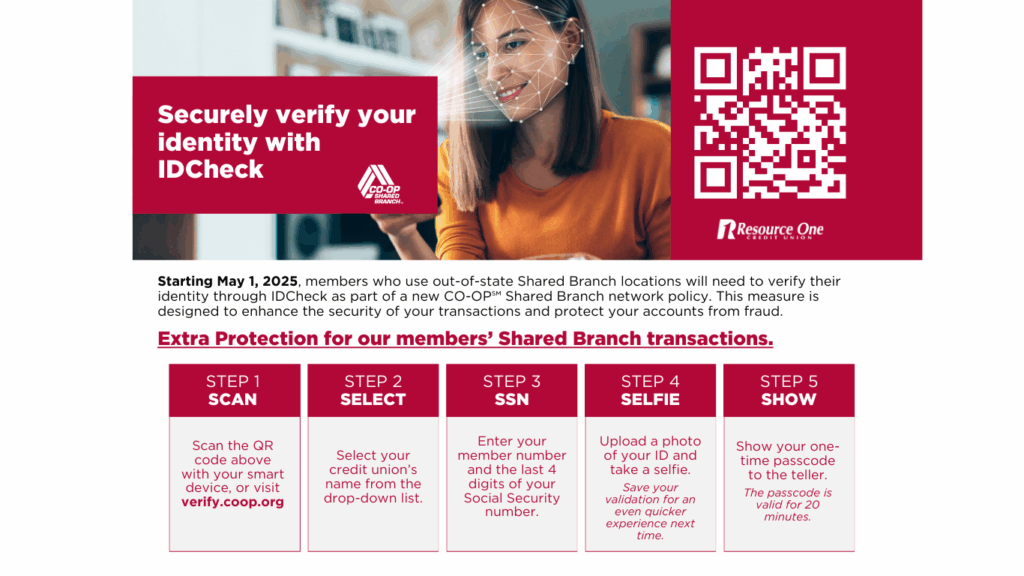

New Shared Branch Verification System for Out-of-State IDs – Effective May 1, 2025

Starting May 1, 2025, our Shared Branch network will implement a new verification system for out-of-state IDs. This enhancement aims to streamline member services and ensure secure access across all participating locations.

What This Means for You:

- Enhanced Security: The updated system provides a more robust verification process for out-of-state identification cards.

- Smooth Transactions: Members visiting branches outside their home state can expect a seamless experience with the new verification procedures.

- No Action Required: Members do not need to take any steps; the system update will be implemented automatically.

Quick Guide: What to Expect with IDCheck

Visiting a shared branch with an out-of-state ID? Here’s how IDCheck makes it easy:

- Scan the QR code at the branch or go to verify.coop.org.

- Choose your credit union and enter a few details.

- Snap a photo of your ID, take a quick selfie, and you’re done!

- Get a one-time passcode (good for 20 minutes) to show the teller.

Pro Tip: Save your ID and selfie to skip most steps next time—just scan and go!

FAQs

Do I need to do this every time?

No. If you save your info the first time, future visits are much faster.

What if I’m a Resource One Credit Union member visiting a Resource One Credit Union branch?

This only pertains to partner branches within the shared network, so no action is needed on your end.

Can I use a military ID?

Military IDs aren’t supported in this system due to federal rules. Ask the branch staff for other ways to verify.