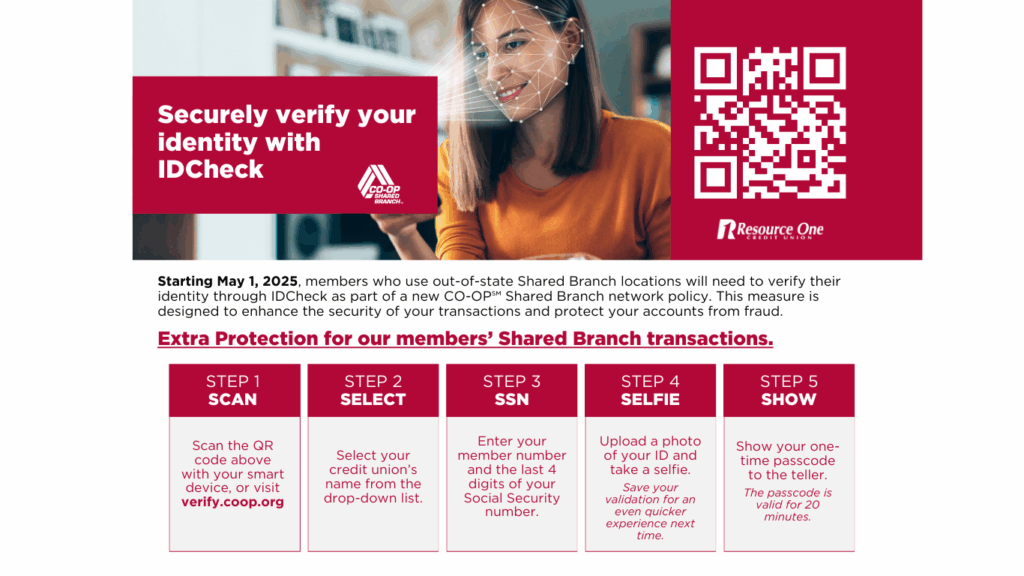

New Shared Branch Verification System for Out-of-State IDs – Effective May 1, 2025

Starting May 1, 2025, members who use out-of-state Shared Branch locations will need to verify their identity through IDCheck as part of a new CO-OP℠ Shared Branch network policy. This measure is designed to enhance the security of your transactions and protect your accounts from fraud.

How it Works:

- Scan the QR code located in the branch or visit verify.coop.org

- Select America’s Credit Union from the drop-down list.

- Enter your member number and the last four digits of your social security number.

- Upload a photo of your ID.

- Take a selfie

Tip: Save your validation for an even quicker experience next time! - Show your one-time passcode to the teller (passcode is valid for 20 minutes).

Important Note: If you are unable to verify your identity, your out-of-state transactions may be limited or denied. This policy is in place to help prevent unauthorized access to your accounts.

Military ID Exclusions

Please note that military IDs are excluded from the identity verification process for out-of-state Shared Branch transactions. If you are using a military ID, it will not be considered an “out of state” ID for this purpose.

After careful consideration, Resource One Credit Union has made the difficult decision to close our North Dallas location at 12770 Coit Road, Suite 100, Dallas, TX 75251, effective June 30, 2025. This decision is driven by changing market conditions and evolving member needs. Until the closure, our team will continue to serve you as usual. If you have a safe deposit box at this location, please arrange to transfer it by June 30, 2025, either in person or by calling 800-375-3674. Our North Garland and Southside branches are available to assist you. For additional information, including Frequently Asked Questions, please refer to the “IMPORTANT INFORMATION and DISCLOSURES” section at the bottom of the page. The FAQs are available for print and have been sent to all members as part of the March 2025 statements. If you have any questions, feel free to reach out to our virtual branch at 800-375-3674 or [email protected].

Protecting yourself against fraud is essential to safeguarding your personal and financial information. Fraud can take many forms, including identity theft, where criminals use your personal details to open accounts in your name, and phishing, where scammers impersonate trusted organizations to steal your sensitive information. Card fraud and account takeover are other common threats, where fraudsters gain access to your accounts through stolen cards or credentials. To protect yourself, always be cautious when sharing personal information online, avoid clicking on suspicious links, and use strong, unique passwords for each account. Regularly monitor your accounts for any unauthorized transactions, and report any suspicious activity immediately. Additionally, be wary of unsolicited phone calls or emails asking for sensitive information, and always verify the identity of the requester before providing any details. If you suspect fraud or have any concerns, always contact us at 1.800.375.3674 or visit us for assistance. By staying vigilant and informed, you can reduce your risk of falling victim to fraud and keep your financial security intact.

New Shared Branch Verification System for Out-of-State IDs – Effective May 1, 2025

Starting May 1, 2025, our Shared Branch network will implement a new verification system for out-of-state IDs. This enhancement aims to streamline member services and ensure secure access across all participating locations.

What This Means for You:

- Enhanced Security: The updated system provides a more robust verification process for out-of-state identification cards.

- Smooth Transactions: Members visiting branches outside their home state can expect a seamless experience with the new verification procedures.

- No Action Required: Members do not need to take any steps; the system update will be implemented automatically.

Quick Guide: What to Expect with IDCheck

Visiting a shared branch with an out-of-state ID? Here’s how IDCheck makes it easy:

- Scan the QR code at the branch or go to verify.coop.org.

- Choose your credit union and enter a few details.

- Snap a photo of your ID, take a quick selfie, and you’re done!

- Get a one-time passcode (good for 20 minutes) to show the teller.

Pro Tip: Save your ID and selfie to skip most steps next time—just scan and go!